There are various complexities in evaluating skills shortages and estimating the future supply of the workforce because occupations often cut across a range of qualifications and pathways, and most of these relationships are not one-to-one. As a Jobs and Skills Council (JSC), the Australian Mining and Automotive Skills Alliance (AUSMASA) looks after the mining and automotive industries. This article provides important insights into the role of VET, Higher Education, and Skilled Migration systems in responding to labour shortages and employment demands for several key occupations in mining and automotive.

Supply from VET and Higher Education streams

For occupations with feed-in streams from higher education, like Mining Engineering, Geologist, Geophysicist and Hydrogeologist, completions are only available by broad fields of education,[1] which are less precise than those in VET. Geologists, Geophysicists, and Hydrogeologists could have studied a range of science qualifications unrelated to mining.[2] Overall, completions in the engineering streams (like Mining Engineering), albeit high, have been declining, indicating limited future supply in related occupations from higher education. Specifically, from 2019 to 2023, Engineering & Related Technologies completions fell to 20,850 (-15.2%), as Natural & Physical Science completions rose to 29,022 (+4.2%).

VET qualifications, on the other hand, have clearer links to industry as various qualifications can be linked to underlying skill competencies or licencing requirements specific to certain occupations. As a result, completion of VET qualifications may be a better indicator of future workforce supply. For instance, automotive occupations increased in size by 40.49% from 2019 to 2023. This equated to increases in completions of 1,056 (+153.49%) for Automotive Electricians, 5 (+100%) for Panelbeaters[3], 1,162 (+46.70%) for Drillers, Miners and Shot Firers, 291 (+41.45%) for Motor Vehicle Parts and Accessories Fitters, 167 (+39.2%) for Motor Vehicle and Vehicle Parts Salespersons, and 3,743 (+36.44%) for Motor Mechanics.[4] Indicating that the VET system does, on average, respond faster and in a more aligned manner to skills shortages and changing skills requirements than higher education, particularly for the automotive industry.

Met demand through employment and migration

Automotive Electricians saw an increase in employment of 3,689 (+49.06%), while Mining Engineers saw the next largest increase of 3,658 (+31.73%), both higher than their completions at +1,056 and -3,747 respectively. As Mining Engineers were the second most in-demand occupation for skilled migrant workers in its industry pre-COVID-19,[5] while Automotive Electricians were in-demand at a more moderate level across both industries, it is likely that skilled migrants have since contributed to resolving some shortages and contributed to employment growth thus offsetting decreases from domestic tertiary and VET supply.[6] Similarly, Geologists, Geophysicists and Hydrogeologists saw the third-largest employment increase of 2,208 (+18.79%), higher than their tertiary completions (+1,178), while Motor Vehicle Parts and Accessories Fitters saw an increase of 2,120 (+17.16%) – well above VET completions (+291).

Other automotive occupations experienced lower employment growth and lower completions, with increases of 309 (+5.57%) for Vehicle Body Builders and Trimmers, while VET completions remained stable (~560). This is followed by increases of 2,682 (+4.32%) for Drillers, Miners and Shot firers and 4,262 (+4.14%) for Motor Mechanics, both of which are more in line with their respective gains in VET completions at +1,162 and +3,743 respectively, with higher employment growth likely a result of skilled migration compared to pre-COVID levels.[7] However, employment fell by -412 (-4.01%) for Vehicle Painters and -1,887 (-14.97%) for Panelbeaters, despite both being in an official shortage and having stable but slightly higher numbers of VET completions. Employment for Motor Vehicle and Vehicle Parts salespersons fell by -3,755 (-10.49%) as opposed to increasing VET completions (+167). Indicating a disjoint between VET supply and demand in these occupations, possibly driven by mismatches in skill and/or VET qualification level for the two occupations in shortage, and by greater VET supply than could be absorbed via employment for the sales occupations that are not in an official shortage.

Unmet demand indicated by vacancies

Vacancies in our top 10 key occupations increased by 2,468 (+55.77%) from 2020 to 2024, while overall vacancies in all occupations increased by 53.34% (Appendix 1). Vacancies for Panelbeaters and Vehicle Painters increased by 165 (+171.88%) and 22 (+110.00%) respectively. However, VET completions and employment fell in these occupations – a mismatch between the location of employment and vacancies might be causing this trend of growing unmet demand. Whereas Motor Vehicle Parts and Accessories Fitters, Automotive Electricians, and Motor Mechanics saw increases in vacancies by 103 (+78.63%), 198 (+76.45%), and 1,427 (+64.19%), respectively. All three increases were well below gains in the number of VET completions – indicating future supply or excess capacity. The same also appears to hold for Drillers, Miners and Shot firers, where an additional 198 (41.25%) vacancies were well below outright gains in VET completions and employment.

Motor Vehicle and Vehicle Parts Salespersons on the other hand, despite growth in VET completions and a decrease in employment, saw an increase in vacancies by 328 (+62.84%). As this occupation is not officially in shortage and saw the single largest fall in employment outright and in percentage terms, this increase in vacancies may be unusual.[8] In contrast, Vehicle Body Builders and Trimmers flat VET completions and lower, but positive, growth in employment coincided with an increase of 13 (+59.09%) additional vacancies; which may illustrate a reasonable degree of balance between supply and (met and unmet) demand. A degree of balance also held for the two tertiary qualified occupations, where largely unchanged vacancy figures – with an increase of 23 (+3.32%) for Mining Engineers and 9 fewer (-6.25%) vacancies for Geologists, Geophysicists and Hydrogeologists – appeared to be kept in check by notable outright gains in employment that also outstripped completions.

Conclusion

This analysis, presented for the Australian VET Conference 2025, underscores the critical role of VET in addressing skills shortages in the mining and automotive industries. The data shows that VET completions have generally increased for our key occupations overall, and more than those from the tertiary system. However, some shortages persist, illustrated by high vacancies for occupations like Panelbeaters and Vehicle Painters, alongside contradictory growth in both VET completions and vacancies for occupations not in shortage like Motor Vehicle and Vehicle Parts Salespersons, which may highlight the need for more targeted interventions to align VET supply with market or employment demands. Moreover, the apparent contribution of skilled migration to occupations like Automotive Electricians illustrates how demand in excess of VET completions can be met from elsewhere. Where any shortfalls are identified, we would encourage providers and employers to work together to meet the evolving needs of our industries and ensure a robust and capable workforce for the future.

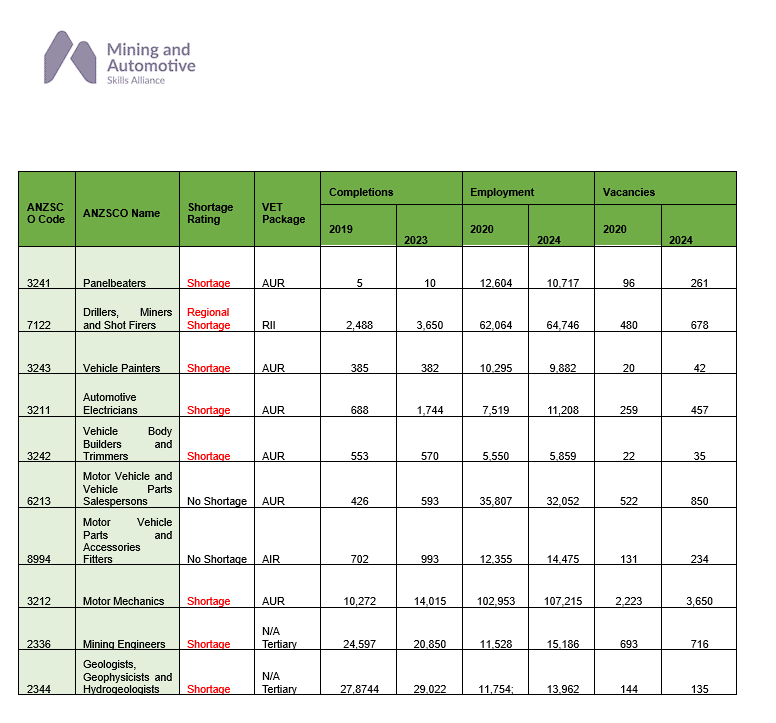

Appendix 1: Key occupations by industry and shortage rating, with completions, employment and vacancies

Source: NCVER, VOCSTAT, TVA program completions 2015-2023; Employment & Vacancies: JSA, Atlas, Occupations, Feb 2020-Nov 2024.

[1] Such as; Engineering & Related Technologies or Natural & Physical Science

[2] Mining engineers could have engineered in Geotechnical engineering for example.

[3] Note: No current VET qualifications for Panelbeaters exist, as they were superseded by one for Vehicle Body Builders and Trimmers.

[4] The occupation motor mechanic is known as Automotive Technician under OSCA

[5] AUSMASA, Research Bulletin – February 2025.

[6] Australian Bureau of Statistics. 2021 Census – Census of Population and Housing, 2021, TableBuilder.

[7] AUSMASA, Research Bulletin – February 2025.

[8] JSA suggests that this trend is a result of that changes to the role and employer attempts to continue to ride the post-COVID-19 boom in vehicle sales may be responsible; Jobs and Skills Australia, Vacancy Report January 2024.

Author Profile

- Dr. Aneeq Sarwar (He/Him)

-

Senior Manager, Workforce Planning and Policy

Workforce Strategy and Industry Engagement

Latest entries

VETFebruary 28, 2025Bridging the Skills Gap in Mining and Automotive

VETFebruary 28, 2025Bridging the Skills Gap in Mining and Automotive